Renters Insurance in and around Houston

Looking for renters insurance in Houston?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

No matter what you're considering as you rent a home - number of bedrooms, price, utilities, condo or townhome - getting the right insurance can be vital in the event of the unpredictable.

Looking for renters insurance in Houston?

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

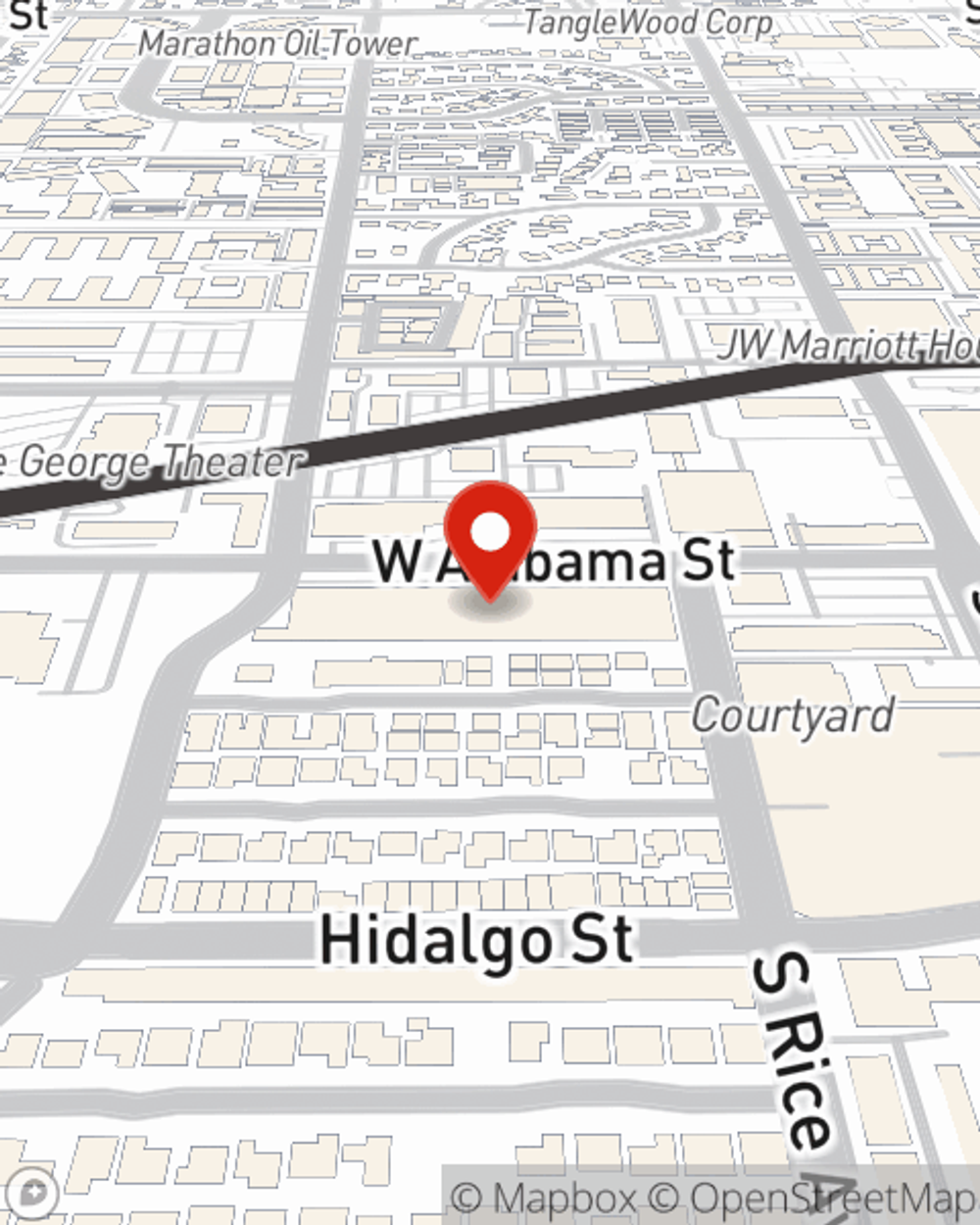

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your valuable possessions with coverage. If you experience a burglary or abrupt water damage, some of your possessions might have damage. Without insurance to cover your possessions, you might not be able to replace your valuables. It's scary to think that in one moment, you could risk losing all your possessions. Despite all that could go wrong, State Farm Agent Felicia Olowu is ready to help.Felicia Olowu can help offer options for the level of coverage you have in mind. You can even include protection for valuables when they are outside of your home. For example, if your personal property is damaged by a fire, your car is stolen with your computer inside it or your bicycle is stolen from work, Agent Felicia Olowu can be there to help you submit your claim and help your life go right again.

It's always a good idea to make sure you're prepared. Visit State Farm agent Felicia Olowu for help learning more about savings options for your rented property.

Have More Questions About Renters Insurance?

Call Felicia at (281) 745-9067 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Felicia Olowu

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.